[ad_1]

The CEO of Cryptoquant says that Bitcoin is actually one of the foundations now after BTC accumulates quickly through Michael Silor’s strategy (MSTR).

In a post on the social media platform X, Ki Young Ju tells its 422200 followers that although Bitcoin enlarges, the strategy escapes from coins at a faster rate than mining workers.

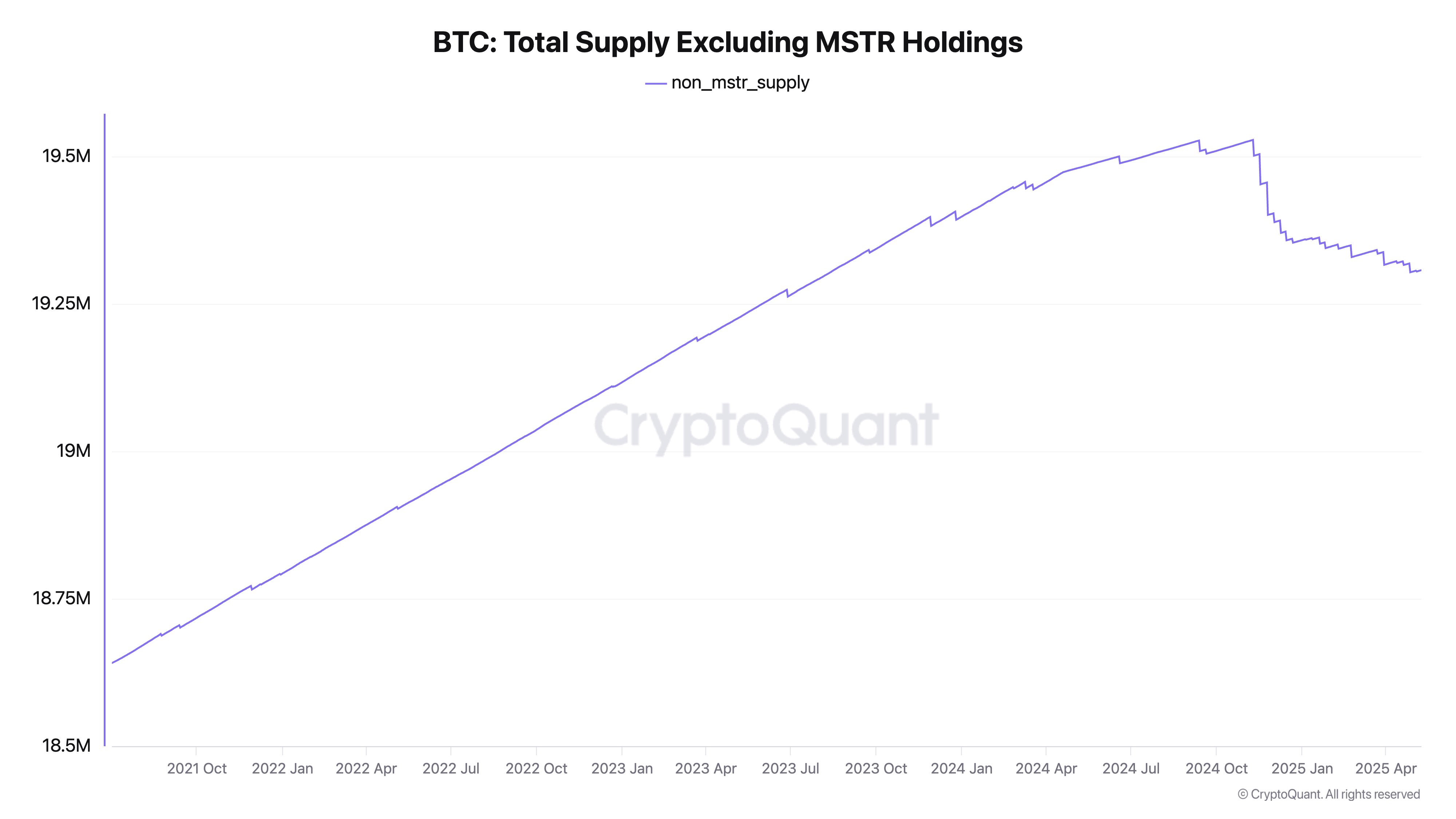

It seems that Cryptoquant data shows that when the MSTR coins are excluded, BTC supplies have decreased since late last year.

Bitcoin is the shrinkage.

The strategy is to buy BTC faster than mining. 555,000 BTC is not liquid with no plans for sale. MSTR property alone means an annual contraction -2.23 % -it is likely to be higher with the owners of other stable institutions. “

according to Bitcointreasuries.netThe strategy has 55,450 BTC with a value of about $ 58 billion, which represents 2.645 % of the 21 million bitcoin offer.

Joe recently retreated from his previous invitation, which ended the Bitcoin market. The CEO said that the Bitcoin market structure is more complicated now, with many different big players, making prediction more difficult.

According to the CEO of CEO, pressure on BTC has eased in the face of “huge flows” from the stock boxes (ETFS).

“In the past, the Bitcoin market was very simple. The main players were old whales, miners and new retail investors, who mainly transport the bag to each other. When retailers dried up and the old whales began at the same time, it was relatively easy to predict the seed of the cycle.

But now, Bitcoin market has become more diverse. ETFS, Microstrategy (MSTR), institutional investors, and even government agencies are studying the purchase and sale of bitcoin. In the past, courses for profit were operated when whales were spent in peak, which led to a series of sales and low prices. “

At the time of this report, Bitcoin is traded for $ 114,112.

Follow us xand Facebook and cable

Don’t miss a rhythm – Subscribe to deliver email alerts directly to your inbox

Check the price procedure

Browse the daily Hodl Mix

& nbsp

Disclosure: The views expressed in Daily Hodl are not an investment advice. Investors must do due care before making any high -risk investments in bitcoin, cryptocurrency, or digital assets. Please note that your transfers and trading on your own responsibility, and any losses you may bear are your responsibility. Daily Hodl does not recommend buying or selling any encrypted currencies or digital assets, and Hodl Daily Andersor is an investment. Please note that the daily Hodl participates in dependent marketing.

Created Image: Midjourney